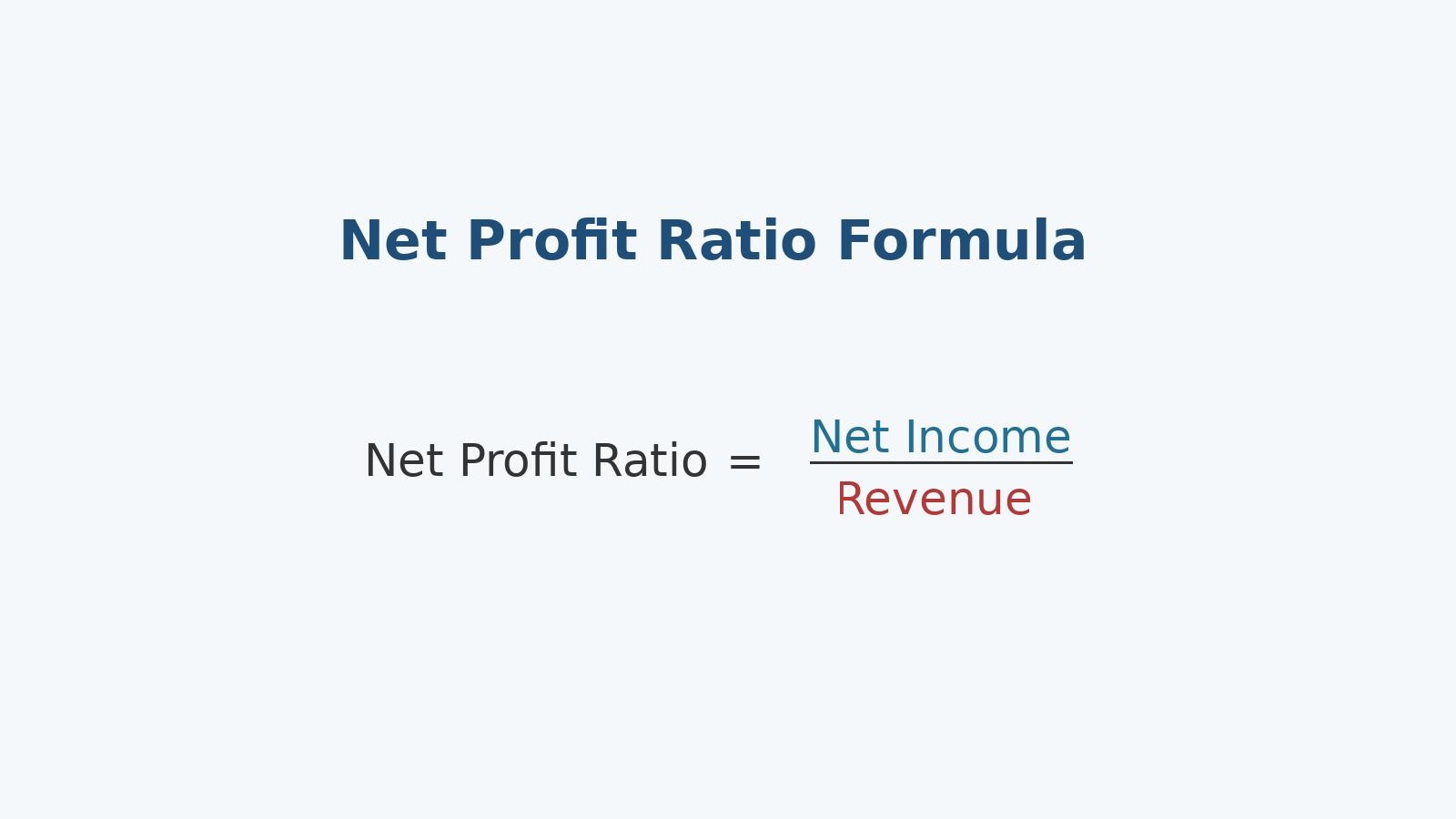

Profit Ratio: Definition, Calculation, and Best Practices

Profit ratio, also known as profit margin ratio, is a financial metric used to measure the profitability of a business. It represents the percentage of each dollar of sales that is kept as profit after deducting all expenses, including operating expenses, taxes, interest, and depreciation. The profit ratio is calculated by dividing the net profit […]

Read More

Budgetary Control System: An Overview and Key Features

A budgetary control system is a process of monitoring and managing an organization’s financial resources through the creation of a budget, setting targets, and comparing actual performance against budgeted performance. The aim of the system is to ensure that the organization’s financial resources are used efficiently and effectively to achieve its objectives. The system involves […]

Read More

Profit Volume(PV) Ratio: Definition, Formula, and Interpreting

The Profit Volume (PV) Ratio is a financial metric that measures the relationship between a company’s profits and its sales volume. It is expressed as a percentage and is calculated by dividing the company’s profit by its sales revenue. The PV ratio provides valuable insights into a company’s financial performance, particularly its ability to generate […]

Read More

Cost Reduction in Supply Chain Management

A supply chain refers to the entire network of companies, individuals, and resources involved in the creation and delivery of a product or service, from the raw materials stage to the final delivery of the product to the end customer. This includes all the activities involved in the production, transportation, and distribution of goods or […]

Read More

Assets vs. Inventory: Understanding the Difference

Assets refer to all the resources that a company owns or controls that can provide future economic benefits. These resources can be tangible or intangible, and they are reported on the company’s balance sheet. Inventory, on the other hand, refers specifically to the goods a company has on hand that it intends to sell in […]

Read More

How to Keep Track of Expenses and Profit?

As a business owner, keeping track of your expenses and profit is essential to understand your financial performance and make informed decisions about your business. Properly tracking your finances can help you identify areas for improvement, stay compliant with tax laws and regulations, and avoid cash flow problems. In this article, we will discuss the […]

Read More

Inventory Journal Entries: Importance and Best Practices

An inventory journal entry is a type of accounting entry that is used to record transactions related to a company’s inventory. It is a record of the movement of inventory items in and out of the company’s possession, as well as any adjustments made to the inventory account. Inventory journal entries are essential for keeping […]

Read More

Budgeting Essentials for Small Businesses: Planning for Success

In simple terms, budgeting for a small business is the process of planning and managing your finances. It involves estimating your income (sales) and expenses (costs) over a specific period, usually a year or a quarter. This plan helps you make informed financial decisions, track your progress, and achieve your business goals. Here are some […]

Read More