Accounting Basics: Introduction to Financial Statements

Accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions. Accounting plays a crucial role in businesses of all sizes, from small startups to large corporations, as it enables them to keep track of their financial activities and assess their financial performance. In this […]

Read More

Accounting 101: Key Accounting Terminology and Concepts

Accounting is the process of recording, summarizing, analyzing, and reporting financial transactions of a business or an organization. This includes identifying, measuring, and communicating financial information to internal and external stakeholders to assist in decision-making, planning, and controlling financial resources. The primary goal of accounting is to provide accurate and reliable financial information that can […]

Read More

What Is a Balance Sheet and Why Is It Important for Businesses?

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It lists the company’s assets, liabilities, and equity. The balance sheet follows the accounting equation, which states that assets must equal liabilities plus equity. The purpose of the balance sheet is to provide […]

Read More

Understanding the Key Components of an Income Statement

An income statement, also known as a profit and loss statement, is a financial report that shows a company’s revenue, expenses, and net income (or loss) over a specific period of time. It provides a summary of a company’s financial performance during the period covered by the statement. Importance of Income Statements for Businesses: Income […]

Read More

Cash Flow Statement: A Comprehensive Guide

A cash flow statement is a financial report that shows how much cash is generated and used by a business during a specific period. It provides an overview of the inflows and outflows of cash and helps stakeholders, such as investors and creditors, to understand the financial health of the company. The cash flow statement […]

Read More

A Guide to Inventory Cost Management to Boost Your Profits

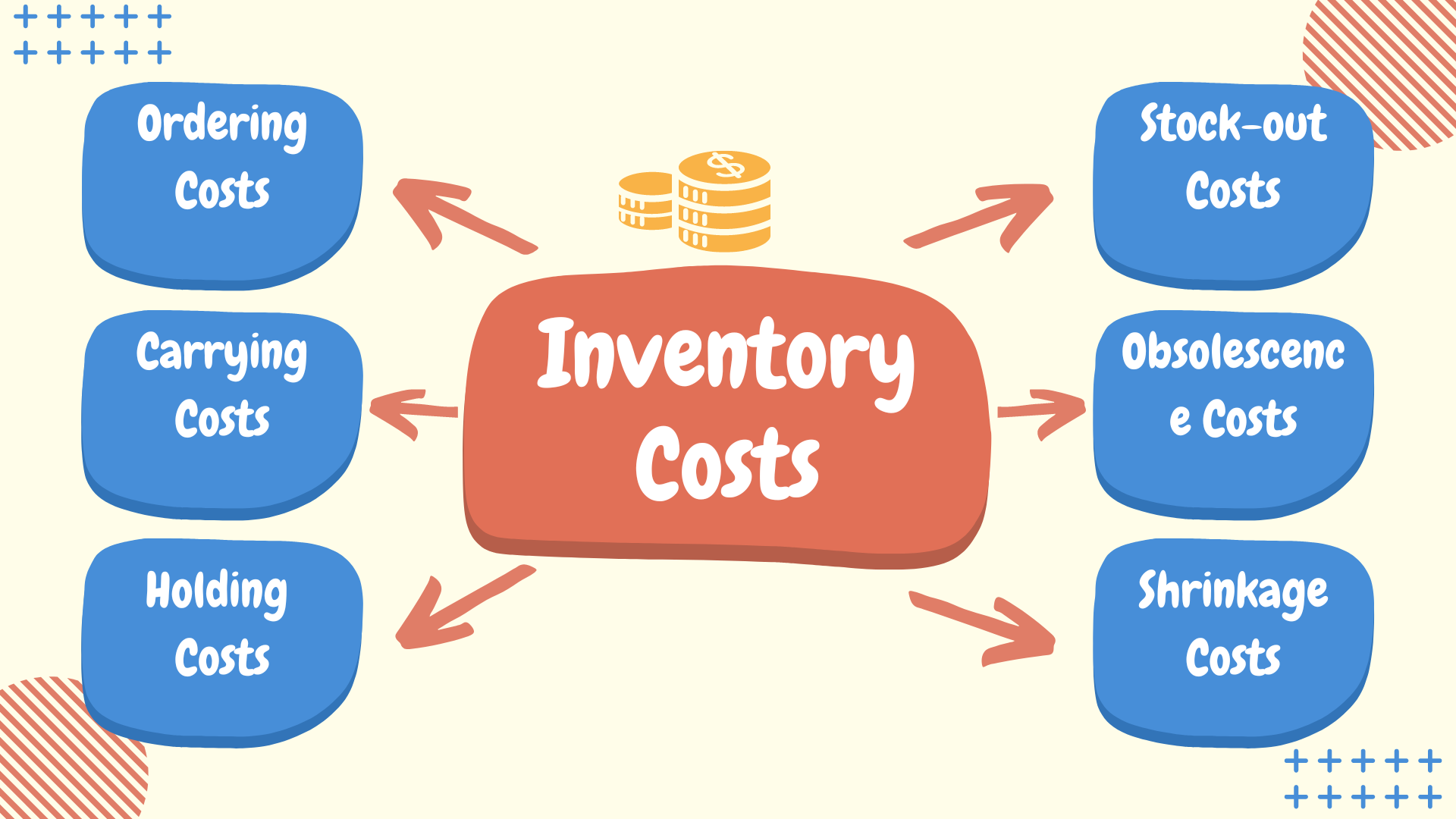

Inventory costs are the expenses incurred in holding or storing goods for sale. It includes costs such as purchasing, storage, handling, insurance, and obsolescence. Companies strive to maintain a sufficient level of inventory to meet customer demand while keeping inventory costs low in order to increase profitability. Inventory cost is one of the most important […]

Read More

The Importance of Financial Statements: A Comprehensive Guide

In today’s business landscape, understanding the financial health of a company is crucial for investors, entrepreneurs, and managers alike. Financial statements provide a window into a company’s financial activities and performance, allowing stakeholders to assess its financial health and earnings potential. In this comprehensive guide, we will explore the basics of financial statements, including their […]

Read More

Landed Cost: The Hidden Gem for Business Success

Landed cost refers to the total cost of bringing a product to its final destination, encompassing all expenses incurred from the point of origin to the point of sale. It goes beyond the simple purchase price and considers various additional costs associated with importing or exporting goods. Landed Costs: A Breakdown of Specific Examples The […]

Read More

Inventory Write-Down: An Essential Guide for Businesses

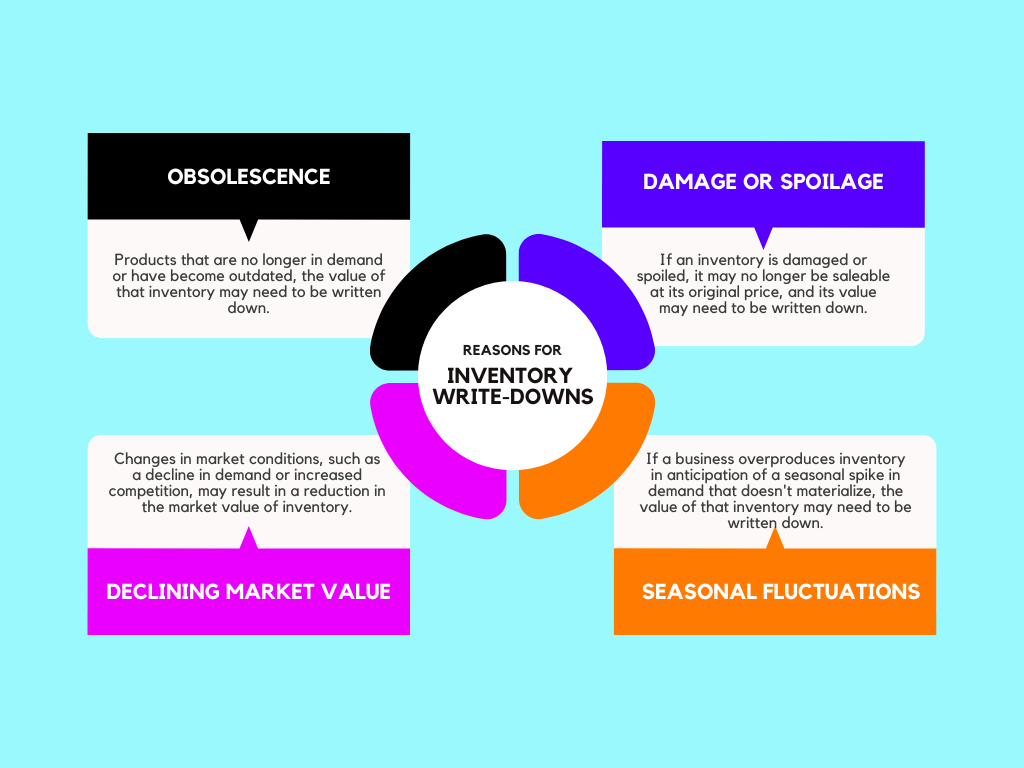

An inventory write-down is a reduction in the value of a company’s inventory due to a decrease in its net realizable value (NRV), which is the estimated selling price of the inventory minus any costs associated with its sale. It reflects a loss in the value of the company’s inventory and is a non-cash expense that […]

Read More

Profit Margin vs Markup: Differences & Calculations

Margin and markup are both important concepts in business and finance that are used to determine profitability and set prices. Margin refers to the percentage of profit a business makes on the sale of a product or service. It is calculated by subtracting the cost of the product or service from its selling price, and […]

Read More